What Are Iceberg Orders in Crypto and How To Use Them

An iceberg order is a way to buy or sell large quantities of cryptocurrency. It is defined by dividing big crypto transactions into smaller chunks.

We're not referring to what happened to the Titanic, or the effects of global warming, but much closer to home, in the crypto world.

The crypto market is used to the up and down cycles it goes through. Despite all the low points the crypto world has reached over the years, each time it came back stronger and aiming for new heights.

Play-to-earn crypto games enthusiasts should know that the current bearish market is temporary and once they weather the storm, the sun will come out on the other side and the price level of their cryptocurrency tokens will rise again.

It's not news that the crypto market is highly volatile and easily influenced by external factors like affluent people or crypto whales, for example. Famous and wealthy people, like certain tech moguls, can disrupt the cryptocurrency market only by tweeting about it.

On the other hand, whales or investors with a huge chunk of crypto in their wallets can also influence the crypto sphere greatly, simply by buying or selling huge amounts of crypto at once.

There is a way to creat a sense of order in the crypto market, and that is by using iceberg orders.

In today's article, we'll define an iceberg order, explain how it can work as a financial tool to address the aforementioned issues, and discuss how it can have a positive impact on the crypto market. Let's start now!

What is an iceberg order?

An iceberg order is a way to buy or sell large quantities of cryptocurrency. It is defined by dividing big crypto transactions into smaller chunks.

When large institutional investors or crypto whales do such big crypto transactions all at once, it has a huge impact on the market, causing undue price movement. A big trading order divided into smaller transactions prevents substantial shifts in the crypto market and the general panic that comes with them.

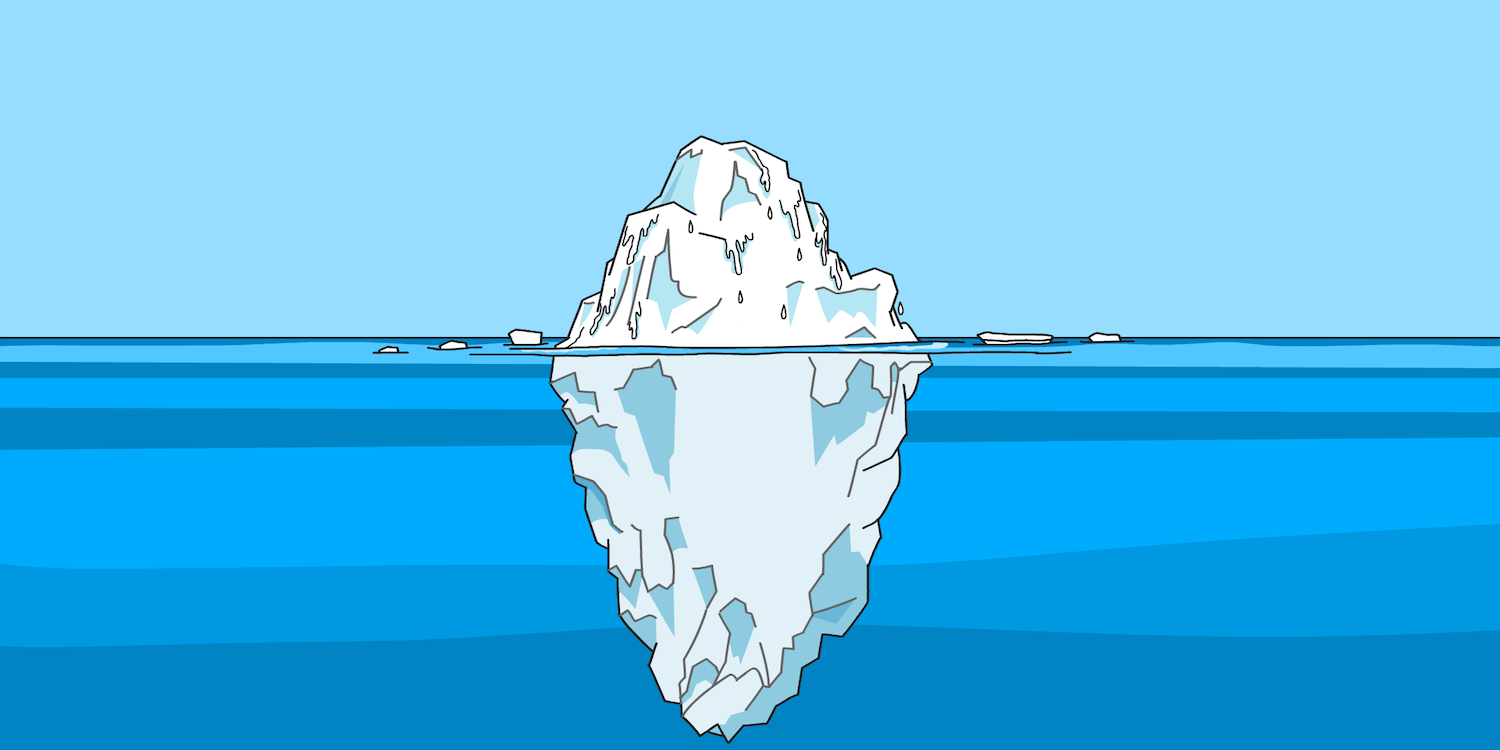

Iceberg orders use an automated program to divide one big single order into smaller limit orders. The name comes from the fact that the visible orders are just "the tip of the iceberg." In contrast, the hidden orders or reverse orders are not visible, just like the central part of an iceberg remains under the water's surface.

Large institutional investors divide large quantity orders in this structured manner not to disrupt the trading market with one single gigantic drop. By hiding the actual order quantity, the person placing the iceberg order maintains a sense of stability in the market. Traders can profit by buying shares just above the price level supported by the initial batch of an iceberg order.

How do iceberg orders work?

Experienced traders learn from other traders and their past mistakes. Since it's widely known that large shifts in the crypto market can create buying pressure and destabilize the price, both institutional and private traders prefer to use iceberg orders to sell large amounts in smaller orders.

By dividing a large order into several small portions, investors manage to stay off the radar and don't influence the demand and supply on the market. This way, they are able to execute each limit order at their desired price.

Real-world example

For example, let's imagine a large-scale trader who wants to buy or sell 1000 BTC. Such a large market order placed at once on the order books would lead to substantial changes in the cryptocurrency's price. If they decide instead to use an iceberg order on an exchange, that large order will be programmatically divided into smaller chunks. The trader can set the order to be filled in 10 orders of 100 BTC each, or even less.

Where to place an iceberg order

Since an iceberg order has both visible and hidden orders, that means that only a small portion will be displayed on the order book. Only a small part of the order is visible initially. Once that gets executed, the hidden part is passed on to the exchange's order book.

You should know that iceberg chart trading is not possible on any regular trading platforms. To be able to place iceberg orders, you need platforms that provide direct market access (DMA). A strong technologically developed platform like BitMEX or BitFinex gives direct market access to the order books necessary for placing an iceberg order.

Who uses iceberg orders

Smaller investors don't really need to place an iceberg order, as they don't have the tendency to play havoc with the crypto market. Market makers are the ones that primarily use this type of order. What are market makers? Simply put, any individual or firm providing offers and bids is considered a market maker.

When it comes to investors that have the potential to start trading big amounts, we're usually talking about crypto whales or large institutions. If you don't remember, a crypto whale is an individual that has had large amounts of cryptocurrency tokens in his wallet for a long time. If he decides to sell all his available liquidity at once, not only would he make it to the crypto news, but it would ultimately turn the market upside-down.

Anyone that wants to buy or sell a considerable amount at once should know that such a transaction stands out in the order books. That's where the iceberg order comes in to save the day, keeping the hidden orders off the order books until the investor executed the first transactions.

Identifying iceberg orders

If you're wondering if there's a way to identify iceberg orders, the answer is yes. It can be done. You need to look into the level 2 order books. Level 1 gives basic information, like price data, without offering any extra details. Level 2, on the other hand, contains more detailed information, including market depth up to 10 best bids and offer prices and real-time data collection.

Go in depth in the Level 2 order books and look for any patterns, like orders with a similar price. Since the orders are executed based on a logistical plan, any small investor can observe an iceberg order by looking at the trading columns.

Iceberg order example

Let's say a sizable investment fund wishes to invest $10 million in a specific stock. This particular stock's price might rapidly increase following news of the fund's investment. The fund creates an iceberg order that divides its initial order into smaller lots of $250,000 or $500,000 a piece in order to prevent such a disruption.

The same can apply to a hotshot investor that wants to buy or sell a significant chunk of crypto. The market doesn't notice the sale, and the price remains the same.

A crypto exchange usually prioritizes orders based on the sequence they are received. That's why the visible part of an iceberg order gets executed first. In contrast, the hidden part is executed only when it becomes visible.

Iceberg orders prove to be an excellent financial instrument for those who want to buy or sell large amounts at the same price without creating unnecessary panic.

How do investors place an iceberg order in the crypto market?

An institution or person placing an iceberg order goes to platforms that provide direct market access to any market makers. They divide the transactions into micro orders that the public doesn't see, allowing the investors to limit orders and make considerable transactions without any substantial changes to the current price.

A small investor can benefit from iceberg orders too. When smaller investors see an iceberg order on the order book, they can place orders at the desired price. They can buy or sell the cryptocurrency when the exchange executes the large investor's order.

The ethical dilemma around iceberg orders

We've already established that iceberg orders are used to avoid upsetting the crypto market, seeing how a gigantic drop in the value of cryptocurrencies leads to disrupting the crypto world. All traders suffer from these big transactions, so iceberg orders are used as a safer alternative.

Some believe this is an unfair move for the other investors that don't have this kind of huge impact on the market order and can't create large shifts in crypto prices.

There are exchanges that may choose to implement policies to prevent the manipulation of prices. It is still debatable whether or not iceberg orders represent an ethical dilemma. The small-scale investors who do not notice the presence of an iceberg order will miss out on trading opportunities.

Are iceberg orders a form of manipulation?

The answer is no. Iceberg orders are not a manipulation tool. Large investors use them as a tactic to buy or sell lots of cryptocurrencies without affecting the crypto prices.

Although some may view this as manipulation, it is neither technically forbidden nor regarded as such. On the contrary, iceberg orders prevent manipulation by avoiding an undue price movement.

Last thoughts

We've learned what iceberg orders are and how they are used by institutional and private investors that want to sell large quantities using platforms that provide direct market access without upsetting the crypto world.

We saw that such big crypto transactions have the ability to unsettle all other traders and cause extreme spikes in prices. We understood why it's preferable to have a big trading order divided into several limit orders and how the available liquidity is split up into a hidden part and a visible one. This structured manner in which transactions are executed gives the name, with visible orders being the tip of the iceberg.

We'll conclude with the reminder that this article isn't intended to be trading or investment advice and is just for informational purposes.

Let’s stay in touch:

? Twitter:https://twitter.com/winplatform

? Discord: https://discord.gg/pUJWEEKTpr

? Telegram:https://t.me/winplatform